Polkadot: Redefining Blockchain Niches in a Multi-chain World

Exploring Polkadot's Role in the Future of Blockchain Ecosystems and its Innovative Parachain Model

During the past year, one of the ecosystems we've spent some time involved within is Polkadot. Whilst I believe that Ethereum's position as the defacto blockchain platform is unlikely to change, I do believe that some of the other chains will find valuable niches and user bases that keep them relevant.

In the same way that we have the rule of three in many areas of business — where a few companies establish themselves as the major platform or software vendors think AWS, Azure and GCP in the cloud or OS X, Windows and Linux in operating systems, it’s likely we'll see something similar with blockchain networks.

Hence it's interesting to compare and contrast the different communities insofar as to how they differ and what major milestones they have achieved.

Polkadot is an interesting project in this regard — it came from Gavin Wood, CTO of Ethereum, who proposed the project via its whitepaper in 2016. The Polkadot has a market capitalisation of $6.2bn, making it the 11th largest blockchain ecosystem according to Coinmarketcap.

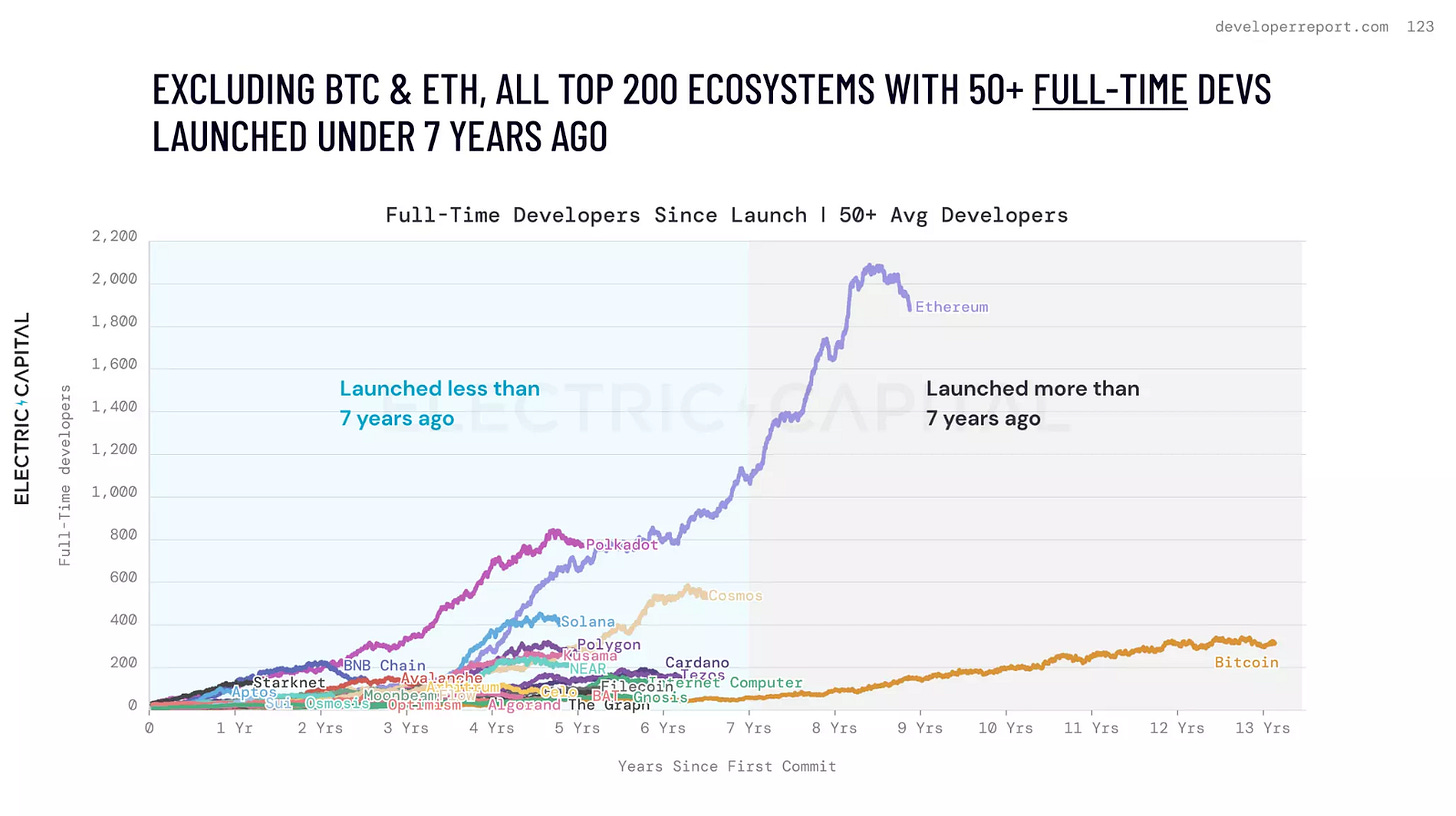

More recently, in the widely circulated Web3 developers survey by Electric Capital, Polkadot stood out by the sheer number of contributors to the project.

Layer 0 and Parachains

Polkadot differs from Ethereum in that it calls itself a layer 0 blockchain, not layer 1 like the Ethereum mainnet. The distinction here is that layer 0 refers to the fact that the network cannot be used for deploying and running decentralised applications on it. You can't deploy your own token on the Polkadot mainnet like you can on the Ethereum mainnet.

In Polkadot, you have two types of blockchain — a Relay Chain and parachains. Relay Chains are your layer 0 chains, and parachains are separate blockchain networks that are secured via the relay chain.

These parachains are where the action happens in Polkadot, and you can think of them as being similar to Ethereum layer 2 networks or app chains. Anyone can create their own parachain using the Substrate Framework created by Parity. This is a modular blockchain deployment framework which allows people to spin up their own blockchain.

Substrate provides a lot of flexibility in that it allows users to specify what features they'd like their blockchain to have. These modular features are bundled as pallets, which provide a variety of different capabilities such as governance and identity models as well as smart contract support via the EVM and other languages.

Crowdloans and Auctions

In order for your Substrate network to be a parachain, it must be secured by the Polkadot Relay Chain. Any Substrate chain is not able to do this. In order to make use of the Relay Chain, a project must obtain a slot on the Relay Chain.

These slots are finite in number, hence projects must bid for a slot via an auction process — a Parachain Slot Auction. During these slot auctions, holders of DOT or KSM (see below) tokens stake them, locking them up in the network with an expectation of reward from the team bidding on the parachain. This is referred to as a crowdloan.

Parachain auctions are held weekly, those Substrate chains that secure a slot become bonafide parachains, where they lease a slot on the relay chain for their network for up to 96 weeks at a time.

Being secured by the Relay Chain is not the only benefit of becoming a parachain, parachains are also able to take advantage of Polkadot’s cross-chain messaging protocol (XCMP) which allows parachains to transact with one another via the Relay Chain.

Whilst in other ecosystems, there are a number of competing approaches for bridging transactions between networks, in some respects one can argue that Polkadot is ahead of other ecosystems by providing a standardised approach to cross-chain communications protocols.

The Ethereum mainnet equivalent in Polkadot is the main Polkadot network Relay Chain, however, unlike most other blockchain networks, a decision was made in Polkadot to create a canary network — Kusama. Kusama is not a testnet, it is an experimental network with its own token KSM, with a market capitalisation of $200m.

A Canary Network

Kusama is intended to be a network for experimentation by teams, and also a testing ground for projects who wish to deploy on Polkadot. Hence projects on the Polkadot Relay Chain will also have another canary network on Kusama too.

There is also a testnet for the ecosystem, this is the Rococo network, which is equivalent to Ethereum testnets such as Goerli where tokens are freely available.

The Polkadot and Kusama ecosystems are collectively referred to as DotSama, encompassing all of the parachain networks and both Relay Chains. Although when most people discuss the Polkadot ecosystem it would encompass the DotSama ecosystem too. For simplicities sake, I will continue to use Polkadot to refer to the DotSama ecosystem too.

Governance on-chain

Governance is another area where Polkadot differs from many other networks, in that instead of adopting a loose governance model more akin to the IETF (rough consensus and running code), Polkadot uses an on-chain governance model.

Instead using of a GitHub repository such as Ethereum’s EIP process, in Polkadot, submissions are made on-chain with links to accompanying documentation which may reside on IPFS in PDF form or a Google doc. These proposals can then be voted on by the Polkadot Council who are an elected body of on-chain accounts. The governance process is far more nuanced, and is discussed in depth here.

Interestingly, one of the other capabilities provided by Polkadot is that on-chain upgrades can be proposed, approved and rolled out on-chain which is another interesting innovation when contrasted with other blockchain networks.

Whilst Polkadot may not be as popular as Ethereum or leading layer 2 networks such as Polygon, what they've managed to create is a very impressive platform and ecosystem.

Smart contracts

They provide compatibility with EVM networks via their EVM Substrate module (the EVM Frontier pallet), however, they've also developed their own WASM-based smart contract language named ink! (yes, the exclamation mark is part of the name).

Ink! is still relatively new, but is the future of Polkadot — the EVM is not intended to be a core building block of the ecosystem. There are parachains such as Moonbeam which are focussed on supporting EVM applications on Polkadot, but most are positioning ink! as the language of the future.

The Parachain Landscape

The parachain landscape largely differs from the Ethereum layer 2 landscape in that many Polkadot parachains are really app-chains, rather than general-purpose blockchains. Typically they have different niche areas that they are focusing on, for example:

Phala Network is a decentralized cloud that offers secure and scalable computing.

Acala is an app chain for finance

Astar is focussed on smart contracts

For a rundown of these different ecosystems, the reports put out by Messari provide a breakdown of the various parachains and metrics such as market cap, active accounts and cross-chain messaging (XCM) activity.

The Future

It's clear that the lion’s share of commercial web3 applications such as DeFi protocols, DAOs and NFTs reside on EVM networks. However, I wouldn't discount the Polkadot ecosystem yet. There are a lot of very smart committed builders within their ecosystem, and the simplicity of the parachain model does appeal to teams.

With the multi-chain future envisioned by many, Polkadot has the potential to be one of the blockchains thriving in this ecosystem, hosting a number of app chains that address real-world problems.

I don't believe it will be the most dominant blockchain in the future, but I do believe it will be significant enough to be an appealing platform for a number of projects. The community and technology are well regarded, it’s only a matter of time before some of the seeds planted in their ecosystem start to thrive and bear the fruits of their labour.