The One Ring: A Golden Ticket in the Digital Age

Understanding Manufactured Scarcity through the Lens of Magic: The Gathering and NFTs

Although blockchain and web3 keep most of my brain cycles busy, I enjoy playing the trading card game (TCG) Magic: The Gathering.

What does Magic have to do with web3? Wizards of the Coasts creators of Magic, may have steered clear of NFTs, but if you want a lesson in manufactured scarcity and physical collectables there are few better examples out there outside of the luxury goods market.

In the world of Magic, last week was particularly notable, with the most expensive Magic the Gathering card ever being found by a collector.

One ring to rule them all

To coincide with the release of their Lord of the Rings-themed Magic set, Wizards of the Coast decided to manufacture a single special edition card of the one ring from J.R.R. Tolkien’s The Lord of the Rings. This card was distributed in a single pack of Magic cards creating what could be described as a modern-day golden ticket, just like in Roald Dahl's Willy Wonker and the Chocolate Factory.

The main difference being except that there was only one golden ticket, and the finder would not get to visit a magical chocolate factory, but instead be the owner of the most scarce Magic card in existence.

Before it was found, the internet was afire with speculation as to whether it would ever be found. Would it remain sat unopened in a collectors storage facility buried for years to come? Or perhaps it would be opened by a child who simply views it as a plaything to go with their other toys and be spoiled within minutes of being found?

Some even said that if they were to find the card, they would travel to a volcano to "cast back into the fiery chasm from whence it came".

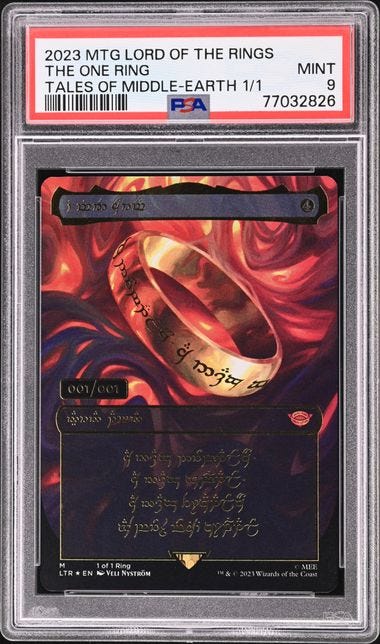

In the end, the card was found by a collector, who recognised its value and took great care to get it to the card grading company PSA who gave it a MINT 9 grading.

Prior to it being found, there had been numerous bounties offered, the most recent being €2m by Gremio de Dregones, a Spanish game store. Given this, it seems likely that a €2m valuation is reasonable for the card.

When you take into account that the most expensive trading card sale ever was $12.6m and the most expensive Pokemon card sale was $5m. A €2m sale would be within the top 10 highest prices paid for a physical card, it’s hard not to see parallels with the NFT market.

A case for NFTs

The activity with the one of One Ring highlights the real demand that exists for manufactured scarcity. NFTs and on-chain assets may have been criticised for their frothiness over the past few years and for being nothing more than overpriced JPGs. But given we have long-running markets for buying and selling trading cards, I see no reason why we won't see collectable NFTs being considered a respectable asset class in their own right.

As it stands NFTs exist in a fuzzy domain among collectors. Unlike trading cards which people genuinely trade with one another, and play with in the case of trading card games such as Magic: The Gathering and Pokemon, NFTs are a different type of collectable.

By and large when someone obtains an NFT they are treating it more like collectable art — they are either purchasing it simply because they like it (which is the reason people should purchase NFTs), or as an investment to ultimately make a profit.

In this respect NFTs are still more art than collectables, the value placed on them by their owners is highly subjective, and buyers are not usually trying to collect a full set of them in the manner certain classes of trading card collectors may.

Longer term I believe that there will be real dual utility of NFTs, whereby some holders are purely retaining them as investments, and others are using them for their utility.

There are already multiple organisations that offer NFT-based memberships such as RealVision and the UK's Crypto Club Global. There are also web3 games such as Mythical Games' NFL Rivals and the Skyweaver trading card games by Horizon Games which use NFTs for utility in the real or virtual world.

But these are the exceptions rather than the norms. In the same way that the majority of crypto is being used for speculation, so are NFTs.

Remember the $69m JPG?

If you consider the eye-watering sums that the record-breaking NFT sale of Beeple's The First 5000 Days for $69.3m secured in March 2021, I'm not convinced we're likely to see something similar happen again in the near term.

The large sums of money that these NFTs sold for was during a bull market, where some of the world's crypto rich were prepared to throw significant funds in the ring, it was not the behaviour of the majority of the world’s ultra-high net-worth looking for investments that will hold their value for the long term.

In these respects the past few years were a unique time in the world of crypto riches that were generated, which I doubt we'll see eclipsed until we have a truly established market for NFTs.

This means the NFT art market maturing, and there being genuine collectables gaining traction from well-established brands. It's far easier for an established brand to manufacture scarcity when they have significant brand equity among their customers.

The Generational Shift

Magic The Gathering is over 30 years old, with an estimated player base of 40 million people. A small subset of this number are true collectors. It will take years for collectable NFTs which are perceived as real collectables to catch on.

I believe it will happen, but there is a mindset shift toward digital assets that needs to happen with this. It is the Zoomers/Generation Z and Generation Alpha where this will be most pronounced. Where they have grown up with web3 and digital assets around them. They will likely be true digital asset natives and the rest of us will be Luddites in comparison.

So what does this mean for the one of One Ring and other trading cards? Whilst the most expensive NFTs are incredibly expensive relatively speaking, it's a cohort of speculators and people who benefitted from being early in crypto or certain NFT projects who were able to drive up the prices.

These people are far more comfortable with the wild shifts in asset prices that are a norm in the crypto/NFT markets, but outside of these asset classes, few have this appetite for risk.

The generational shift from physical to digital collectables may still take decades to materialise, hence the One Ring is likely to retain its value, and if I was to choose between an NFT of my choosing or the one ring, I know where I’d put my money.